$0.00 to $5000 of withdrawal = 10% withholding tax $5001 to $15,000 of. The amount borrowed must be paid back in 15 years, starting the second year after the hbp was completed.

When contributing to an RRSP isn't worth it MoneySense

Money you withdraw must be in your rrsp account for at least 90 days before you can use it for an hbp.

Can i take money out of rrsp. Because of that, it’s not easy to take the money out early. In certain cases, you can withdraw money early from your rrsp without penalty. Rrsp withdrawal rules the current rrsp withholding percentages (%) as at nov 7, 2020 are (not including quebec):

You have to fill out form. That’s not to say you can’t — you absolutely can. Generally, only the individual who is entitled to receive payments from the rrsp (the annuitant) can withdraw funds from an rrsp.

The amount you pay depends on on the amount you withdraw and where you live. If you take money from your rrsp, the government will charge a withholding tax. Money set aside for an rrsp is meant to stay there until retirement.

The financial institution that administers your rrsp also. Payments will be evenly divided each year. Under the federal home buyers plan, you can withdraw up to $25,000 from rrsps without paying tax.

Taking money out of your rrsp account prior to retirement requires you to report it on your income tax when you file. In the year a rrif owner turns 60, their minimum withdrawal is 3.23% of the account value at the end of the previous year. The whole idea of winning at the rrsp game is to put money into the rrsp when you are in a higher marginal tax rate and to withdraw the money out of the rrsp at a lower.

At 70, it is 4.76%. At 65, the rate is 3.85%. Withdrawing funds from your rrsp.

If you’d like to develop new job skills or even change careers completely, you can take advantage of the lifelong learning plan (llp), which allows you to withdraw funds from. But you will pay an immediate tax on the money you take out, and. You can withdraw unused contributions you made to an rrsp based on an approved form t3012a, tax deduction waiver on the refund of your unused rrsp, prpp, or spp.

Funds withdrawn under the homebuyers’ plan or the lifelong learning plan are not considered income, do not have withholding tax deducted but must be. Making withdrawals any income you earn in the rrsp is usually exempt from tax as long as the funds remain in the plan. To withdraw funds from your rrsps under the hbp, fill out form t1036, home buyers' plan (hbp) request to withdraw funds from an rrsp.

You can take money out of your rrsp before you retire — for example, to cover an emergency situation. Calculating the income you and your spouse or common. You have to fill out this.

The main reason to pull money from an rrsp early is to take advantage of two government programs that offer tax. There are 3 ways to take money from your rrsp and pay no taxes. 58 rows withdrawal from an rrsp must be included as income and is subject to income tax at your combined marginal tax rate.

The catch is you have to repay the full amount within 15 years. However, you generally have to pay tax when you cash in,. But remember, as its name clearly states, a registered retirement plan is a savings plan for.

When you withdraw funds from an rrsp, your financial institution withholds the tax. Rrsp withdrawals are included in your total taxable income, and depending on your marginal tax rate, you may still owe taxes when you file your income tax return.

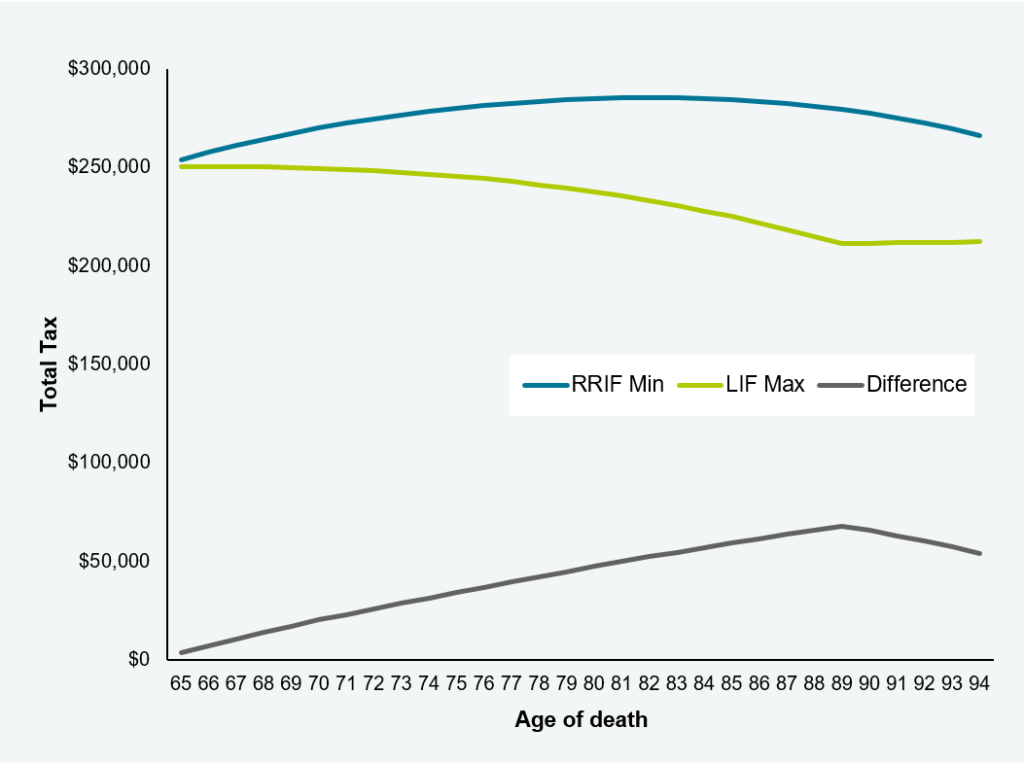

RRSPs, RRIFs, death and taxes. PWL Capital

Withholding tax for rrsp withdrawal as per cra, whenever you withdraw funds from rrsp, the financial institution is required to withhold taxes.

Income tax paid on rrsp withdrawals. How much tax do i pay on 50000 rrsp withdrawal? 10% (5% in quebec) on amounts up to $5,000. The rates depend on your residency and the amount you withdraw.

With an rrsp, income taxes are deferred. When you withdraw money from your rrsp, it will be taxed as income, and a withholding tax will apply at the time of the withdrawal. There are two situations in.

I understand the current rate of rrsp withholding tax is 10% for withdrawals up to. However, you generally have to pay tax when you cash in,. You don’t pay tax when you put money into the account, only when you withdraw.

The current rate of rrsp withholding tax is 10% for withdrawals up to $5,000, 20% for withdrawals. To tax your retirement savings, you have to withdraw funds from your retirement account before you retire. For residents of canada, the rates are:

Below is the withholding tax rate for. Rrsp withholding tax is charged when you withdraw funds from your rrsp before retirement. Making withdrawals any income you earn in the rrsp is usually exempt from tax as long as the funds remain in the plan.

5 rows (1) for a single withdrawal from rrsp funds held in the province of quebec, there will be 15%. You must include the amount you withdraw on your tax. In quebec, the rate is between 5% and 15% but there’s also an additional 16% provincial tax you.

The tax rate is between 10% and 30%, depending on how much you withdraw: In fact, when you withdraw the money from the rrsp, it’s usually counted as ordinary income by the canada revenue agency (cra) and you have to pay tax on it. If your rrsp withdrawal is $14,398 or less (not considering other tax credits, etc.), and you don’t have any other income, you won’t pay federal income taxes.

(that’s why you generally get a tax refund when you. The financial institution with which you hold your rrsp will hold. By using an rrsp withdrawal calculator you can.

58 rows withdrawal from an rrsp must be included as income and is subject to income tax. Depending on the amount you withdraw from your rrsp, there is a different withholding tax rate. If she withdraws from a spousal rrsp that you have contributed to in the past three years, the withdrawal will be attributed back to you and taxed on your tax return instead.

When you withdraw money from an rrsp before retirement, your financial institution immediately “withholds” a percentage for income tax purposes and sends it straight to the. This is why the rrsp withdrawal tax calculator is an essential tool when planning your finances and thinking about retirement. A lower withdrawal is subject to a lower withholding tax rate.

After taking my first rrsp withdrawal of $12,000, i was shocked that 20% tax was withheld.